Makhlouf Sons’ GVC-supported investment elevates the company’s sustainability, profitability, and job creation.

Makhlouf Sons is an Egyptian manufacturer of packaging solutions that sells its production to a variety of clients and businesses in local and export markets. The company owns and operates a production facility in Qalyubia Governorate and sells its products to clients in the food and beverages, retail and pharmaceutical industries.

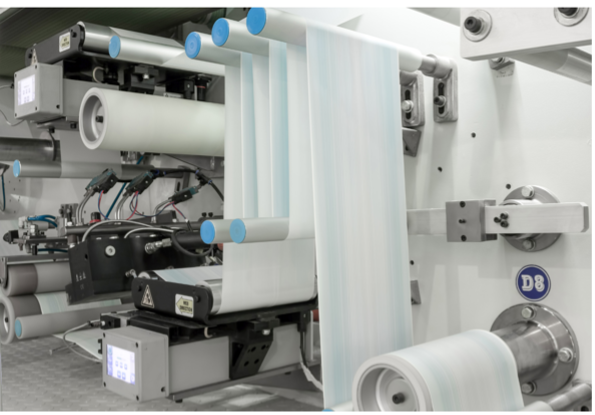

In a move to expand its global outreach and production capabilities, Makhlouf Sons decided to invest in modern technologies, acquiring new machines for non-woven fabric and Polyethylene Terephthalate (PET) sheet production.

The company applied for a $655,640 loan from the Egypt GVC Financing Facility to incorporate recycled materials in non-woven fabric production and adopt energy-efficient PET sheet manufacturing. The investment resulted in the reduction of GHG emissions by 30% and energy savings by 28%.

The investment also increased Makhlouf Sons’ annual profits by EGP 6,693,274 ($eq 217,820). This positive financial impact highlighted the successful integration of profitable sustainability practices in the company’s operational model.

It also led to the creation of 30 new male and 5 female jobs, contributing to local employment opportunities.

The Egypt GVC Financing Facility team evaluated the technical and financial feasibility of the project and provided advice on the best available technologies to enable the company to minimize waste, optimize energy efficiency and profitability.

The Egypt Green Value Chain Financing Facility was developed by the European Bank for Reconstruction and Development (EBRD) and is financially supported by the Green Climate Fund (GCF), the European Union (EU) and the EBRD Shareholder Special Fund (SSF).

The Sub-borrowers receive an investment incentive for successful project implementation, provided by a grant from the EU.