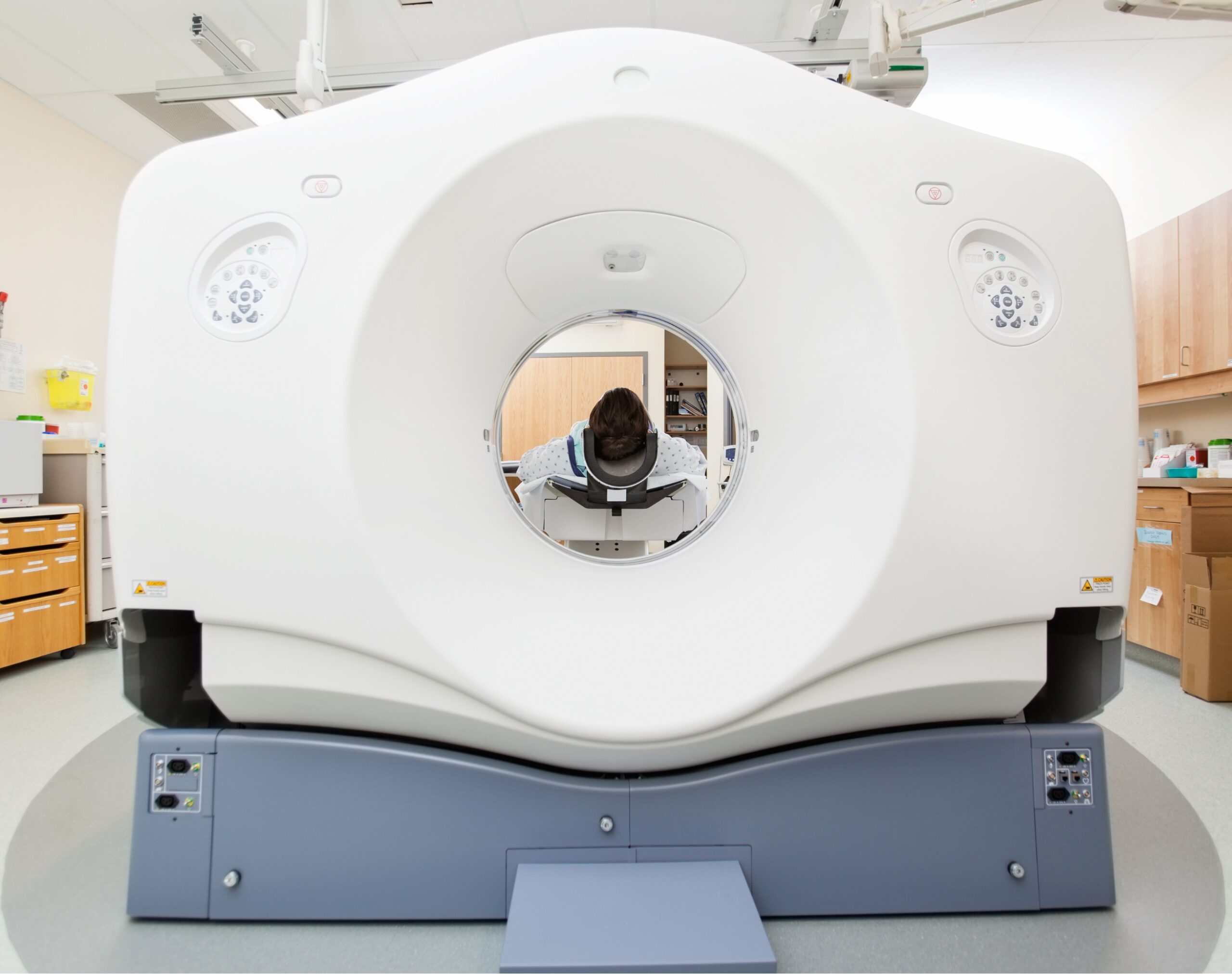

The investment in a new MRI achieved an increase of over $201,000 in annual profits

Located in Beheira Governorate Egypt, Kafr El Dawar Scan is a private medical diagnostic and imaging centre providing radiology services. The centre’s mission has been to enhance its diagnostic capabilities and improve its energy performance.

To accommodate the growing number of patients while optimizing operational costs, Kafr El Dawar invested in new MRI equipment through a loan from the Egypt GVC Financing Facility.

The new MRI Scanner has improved the centre’s energy efficiency, reduced operational costs, and expanded diagnostic capabilities. This investment significantly improved the centre’s financial performance, enhancing its capacity to serve patients more effectively.

As well as the reduction in energy costs by 36%, the investment had a positive impact on the environment through energy savings of 1,043GJ/year represented by a reduction of greenhouse gas emissions of 49 tCO2e/year.

As for the financial impact, the centre achieved an annual profit increase of $201,788 with only a payback period of three years.

The investment had a positive social impact by creating 12 permanent jobs (7 females and 5 males), contributing to local employment opportunities.

The Egypt GVC Financing Facility team evaluated the technical and financial feasibility of the project and provided advice on the best available technologies to enable the company to optimize energy efficiency and profitability.

The Egypt Green Value Chain Financing Facility was developed by the European Bank for Reconstruction and Development (EBRD) and is financially supported by the Green Climate Fund (GCF), the European Union (EU) and the EBRD Shareholder Special Fund (SSF).

The Sub-borrowers receive an investment incentive for successful project implementation, provided by a grant from the EU.